Modelo 720

Modelo 720 - deklarera tillgångar i utlandet

Deklarera tillgångar i utlandet

- Lär dig om Modelo 720 genom att läsa nedan

- Klicka på den röda knappen så hjälper vi dig deklarera Modelo 720

- Lär dig mer om spanska skatter genom att klicka på menyn ovan

Vad är Modelo 720?

Sidan är uppdaterad senast 06/03/2023

Modelo 720 – att deklarera utländska tillgångar när man bor i Spanien.

Om du bor mer än halva året i Spanien så kommer du anses att vara Skatte-Resident i Spanien och ska deklarera alla dina inkomster och tillgångar oavsett var i världen de kommer ifrån.

Om du har kvar bankkonton, fastigheter eller andra tillgångar i Sverige eller annat land så måste du deklarera dessa i Spanien även om det inte innebär att du behöver betala skatt för dessa.

Modelo 720 är en skatteblankett som är avsett för att deklarera utländska tillgångar och är högst kontroversiellt då man hittills riskerat mycket höga böter om man missat att deklarera. Det är mycket viktigt att komma ihåg att deklarera detta innan sista mars året efter taxeringsår för att undvika böter.

Syftet med blanketten är att undvika skattesmitning genom att ha konton eller tillgångar utomlands.

Nedan kan du läsa lite mer om Modelo 720. En del av materialet är på engelska men om du har några frågor så ta gärna kontakt med oss via info@staminawebs.com. Vi pratar svenska.

Efter att du läst lite på sidan kan du även klicka på den röda knappen för att skicka oss nödvändig information så vi kan hjälpa dig deklarera.

Simply put, it is a tax form to inform about foreign assets to intensify the fight against tax evasion.

It is one form to declare three different obligations which are divided in the following groups.

- Inform about foreign bank accounts

- Inform about values, right, insurance and deposits outside of Spain or managed outside of Spain.

- Inform about any properties or rights to properties which are located outside of Spain.

Each group also have some exemptions.

The form is regulated by the following law.

“Orden HAP/72/2013, de 30 de enero, por la que se aprueba el modelo 720, declaración informativa sobre bienes y derechos situados en el extranjero, a que se refiere la disposición adicional decimoctava de la Ley 58/2003, de 17 de diciembre, General Tributaria y se determinan el lugar, forma, plazo y el procedimiento para su presentación.”

https://www.boe.es/diario_boe/txt.php?id=BOE-A-2013-954

It first emerged with the intention to make assets hidden abroad to be declared and came about in conjunction with an amnesty for hidden assets during 2012. You could during a period declare assets from abroad with few sanctions even if you never had declared the assets before. After that period all future assets abroad would have to be declared with the aim of avoiding undeclared assets.

The form is followed by heavy sanctions for not reporting, starting from 1500 euros up to 10 000 euros, without mentioning the tax charge relative to the undeclared assets, which could sum up to 150 % of the assets value! We will later in this article get back to the sanction’s regime, let’s get into some more background.

The form is made of three groups as mentioned where the obligation to declare arises independently in each group. So, if any of the groups reach the requirement you need to declare.

Modelo 720 is a mandatory tax form to inform about foreign assets if you are a tax resident in Spain where missing to declare can lead to so high penalties that the Spanish sanctions are contested by the European Commission. On this page we will go through the background of the form, how it is implemented today and what might happen to it in the future.

The tax form is informative only and does not lead to any tax that needs to be paid.

The story of the tax form began around the financial crisis that struck Spain heavily in 2011-2013. Usually when a financial crisis occurs, states and regulators will try to find out ways to prevent similar events happening again.

When the crisis hit Spain, a lot of focus was put on avoiding tax evasion and collecting all the taxes that were mandatory in Spain. It was not uncommon to hear stories about people who owned big houses and were living large while having small reported taxable incomes. The Spanish government like many others in the world began a search for taxable assets that were hidden from the state.

This finally led to the implementation of Modelo 720 in 29/10/2012 which requires Spanish residents to inform the state of their foreign bank accounts, properties, shares, funds and other assets. The idea is that if everybody reports their assets, they will also need to report income received from these assets in their yearly income tax declaration.

If an asset is not reported and later found to exist, the state would automatically assume that this is an attempt to hide the asset from the tax agency and that the source of the assets is illegal and thus the whole amount to be taxed as late reported earned income including heavy penalties.

We will get back to the possible sanctions which are so high that the European Commission has decided to take Spain to the European court of justice because the tax form is considered abusive, disproportionate and hinder free movement of capital according to the European treaty.

We will get back to the future of the Modelo later in this article. Let’s check out more about the purpose of the Modelo – why does is exist?

The purpose of the Modelo is as mentioned to declare any foreign bank accounts or assets than Spanish Residents may have abroad. It is only an informative declaration and no tax it collected – so what’s the big deal? The idea is that if a person declares the assets, then it will be very difficult not to declare any income received from the assets which in turn are taxable in Spain. So even if you do not have to pay taxes on the asset itself, you will need to pay income tax later during the normal tax declaration period.

Imagine that you are a Spanish resident and have shares worth of 30 000 GBP in a bank account in England. You earn 1000 GBP a year in interest income every year.

If you have not declared that you have 30 000 GBP in a bank account in the UK, the Spanish tax authority might not be aware this income of 1000 GBP.

So, when you report the 30 000 GBP, it will be more difficult for you not to include the 1000 GBP earned interest when you have to present your yearly tax return “La Renta” in Spain.

The tax for the 1000 GBP might be around 200 GBP that the Spanish tax agency would not receive. This is a small example of how Spain would miss 200 GBP in tax payment, but imagine if it is a house worth 700 000 GBP where you earn 70 000 GBP in rental income a year? The Spanish tax authority would miss almost 15 000 GBP in taxes unpaid from the foreign asset! So, there are good reasons for the Modelo 720 to exist from the perspective of the Spanish state and Spanish taxpayers in general.

You might think, oh, so if I do not declare my assets in the UK, in Netherlands, in Schweiz or Sweden I might be able to avoid paying income tax on these assets – Spain will never find them!

Wrong, the Spanish government has signed information sharing agreements with the European countries and many other countries (which do include tax heavens) to share information about owners of assets who are Spanish nationals or Residents. These days it is not that easy to hide assets and the risks are very high as you will find out later in the article.

If a person would hide assets abroad, not declare Modelo 720 and the Spanish government would find the assets, for example through an information sharing agreement the penalties are high. Spain would consider the assets being “not declared income”, as in earned income. You would risk having to pay full income tax on all of the assets including late paying fees and penalties. This leads to the sanction’s regime being extremely tough!

So, if the sanctions are so high and the European Commission is challenging the Spanish state, what will happen?

The future of the Modelo 720 is uncertain but until now the Spanish tax agency continues to issue sanctions. Read more a bit further down and you will see why we might expect a change in the Spanish tax laws regarding the modelo.

Why we talk about the future of the Modelo is simply because there has been talk about stopping the use of it as well as questions if the Modelo still is valid. Sometimes you can hear people saying that it is no longer needed since the Spanish courts have gone against the tax agency – unfortunately this is not true in the year 2020.

It is true that the European Commission has sent Spain a letter in 2017 regarding the tax form where it is stated that the form constitutes a restriction against the freedom of movement and capital in the European treaty. The idea is that the form hinders the movement of people who might choose not to move to Spain because of the risks inherent of not declaring the modelo as well as risk of hindering Spanish residents of having accounts outside of Spain because the increased bureaucracy.

If I wish to invest in shares abroad or with a Dutch broker instead of a Spanish one, why should I need to fill in an extra form? If I wish to buy a holiday home in Biarritz instead of San Sebastian, why I am required to declare this when the Spanish property does not need to be declared in the same way? So, the form might hinder the movement of capital. But does a simple form really do this you might ask yourself?

Well, it is motivated by the complexity of filling in the modelo, which in most cases require a specialized advisor to do it for you. This and the extremely tough sanctions regime which are considered disproportionate by the European Commission, especially compared with other economic crimes. It does also not make sense to sanction wealth created by income abroad which were not declared in Spain if the year of the income tax is far back in time and the tax payment for the income has prescribed.

For example.

If a person earned capital income during 1980-1990 on accounts abroad and did not declare the income in Spain (because it might not have been required to do so), now the account has over 50 000 euros and the person would need to declare the account. Even if the income generated never was taxed, it would be impossible for the tax agency to require a late declaration of income from 1980-1990, but it could in this case regard all the assets as illicit funds and place a sanction even if the income was created over 30 years ago.

Before going too much down to details, let’s start with – do I have to care about this?

As we mentioned earlier, the tax form is valid for Spanish Tax Residents, meaning you are considered by the Spanish state to be a Tax Resident in Spain. To be regarded as a Spanish Tax Resident there are a few different criteria but the most common is that you have decided to reside in Spain more than 183 days a calendar year.

If you want to read more about the criteria to be regarded as a Spanish Tax Resident, please do read our article about Taxes for Spanish Residents which goes through the topic in detail.

Now, let’s assume that you are considered a Spanish Tax Resident.

Do I have to declare?

Well, it depends. There are various thresholds for the tax, but in general if you do have assets valued at more than €50 000 the last day of the year you will need to declare Modelo 720 the following year.

Who else needs to present it? Here is a short list

- Physical persons in Spain who are residents

- Businesses registered in Spain

- Business establishments in Spain who are non-residents

- Heritance estates which are not yet disbursed

- Other entities that form an economic entity.

- Everybody who has a power of attorney of the entity, its representative or beneficiary and who can act on behalf of the entity.

Among the assets that need to be declared are deposits in other countries, investment funds which are deposited abroad, properties outside of Spain and brokerage account which are registered outside of Spain without a branch in Spain, for example the online broker, Degiro.

If you have already presented Modelo 720 in the previous year or earlier, you only have to do it if the value of your assets outside of Spain have increased more than 20 000 euros.

Who needs to present it?

If you have more than 50 000 euros of assets outside of Spain in total, including accounts shares, funds and properties per the last day of the previous year.

We will talk more about the controversy around the Modelo but so far Spain has not followed the demands from the EU and still requires the form to be filled.

So, to sum up:

If you have;

- bank accounts,

- shares,

- investment funds

- insurances (for example unit linked accounts)

- other assets or right

- or property

for example, in the UK, in Netherlands, Switzerland or Sweden, you have to present the form. Remember, this does not mean that there will be a direct tax for the declared assets.

This also includes if you control assets through a power or attorney for example or you are beneficiary of a trust which you can control.

There is no obligation to inform any of the assets in these groups if the sum of the assets does not reach 50 000 euros. In the groups where the sum is higher than 50 000 euros, there is an obligation to report all the assets in the group.

In the following years it will be sufficient to declare if any of the groups have had an increase of more than 20 000 euros in relation to the last reported declaration.

Even if you are not a direct owner of an asset you will have to declare if you are the beneficial owner of the asset. For example, if you own a unit linked insurance account which holds assets, the strict owner of the assets might be the insurance company, but you are the beneficiary and control the assets – so you need to declare them.

This does include if you hold a power of attorney on behalf of other owner and you control the assets through the power.

One example is if a woman is owner of assets on a bank account outside of Spain and her husband holds a power of attorney and right to use the funds, both persons need to make a declaration.

The deadline for the declaration is 31st March each year, a year after taxable year. You can start to declare 1st of January every year.

Let’s take a look at an example.

“I have lived in Spain entire 2021 and on the 31/12/2021 my bank account in England has 60 000 EUR. “

You would have to declare the tax before end of March 2022.

What happens if you moved to Spain in October 2021?

Well, as we have mentioned earlier, the basic requirement for becoming a Spanish Tax Resident is living more than 183 days in the calendar year in Spain. So, if you moved in October 2021, you would not be considered a Tax Resident in Spain for 2021. This means that you would not have to declare the Modelo 720 during the year 2022. But, if you continue living in Spain during 2022 and you have a bank account or other asset outside of Spain by 31/12/2022, you will need to declare Modelo 720 in 31/3/2023.

What is the form D6?

All this talk about Modelo 720, so why are you mentioning a form D6?

Well, they are somewhat related and might be equally important! The form D6 is also an informative form, not from the tax agency, but from the statistics agency in Spain who are responsible for collecting information about foreign trade flows.

Why does this concern me?

Well, because if your foreign assets, which you have to declare in Modelo 720 contain shares or funds which are held are foreign custodians and that are not registered at the Spanish financial regulator, you will also need to present a form D6. The form is similar to Modelo 720 and does have potentially the same strict sanctions regime but until now the sanctions seem not to be applied in the same strict manner. We can only speculate why, probably because the intent of the form is not to find tax evasion but to collect statistics for making better decisions on a macroeconomic level.

Since December 2021 you no longer have to file the D6 form if you do not hold more than 10 % of capital or voting rights of the entity abroad. This effectively abolishes the D6 form for most private investors.

So, what should I do – I do own shares and funds outside of Spain with more than 10 % of the voting rights or capital of the company?

Easy, present the Modelo D6 or let us help you. The Modelo D6 can be submitted at a Spanish government delegation or through a government website using a special program to submit it. It’s not very much fun to do it if you have plenty of shares or funds, so it might be a good idea to get help.

Now you might think, OK, I’ll get some help with that, I guess it’s the same deadline as Modelo 720, so I have until March?

Unfortunately, no. The deadline to submit D6 is already in January of the year following the taxable year.

The possible fines are not that high if you do report late but only if you do it before you “get caught”. Fines from late reporting range around 150-300 euro if you report late before receiving a letter from the government. If you have not done this and you do receive a letter, the sanctions regime is on pair with the Modelo 720 – in other words, very strict!

If you are worried about D6, please do get in touch and we will help you out, info@staminawebs.com.

Now let’s get back to Modelo 720.

If you have previously presented the Modelo 720, you do not need to present it again, unless there has been a change of 20 000 euros or more in any of the assets reported in the earlier Modelo.

Assets that are held outside of Spain for the taxable person.

The assets that need to be declared are divided in three groups.

- Accounts in banks and financial institutions abroad (the average amount for the last trimester and the amount per 31/12).

- Values, rights, investment funds, insurances, trusts, unit-linked schemes and incomes deposited abroad or managed by a person or where the person is the beneficiary.

- Property and rights over property abroad.

The obligation to declare is for any person who have been the title owner, representative, authorized or the beneficiary, who have had a power of attorney or been the beneficial owner any period during the taxable year. This means for example that if a married couple has a bank account which is owned by of the persons, both need to declare if both have access to the account.

- Name and address of the financial institution where the assets are held.

- Identification number of the accounts.

- Opening or closure dates, or date when a power of attorney became valid.

- Amounts of the accounts per 31/12 and the average amount for the last quarter of the year.

- Date when a power of attorney ceased to be valid.

What does need to be declared about assets and rights?

Mandates of assets to others of own funds, life or unit linked insurances, temporary as well as life insurances. The reporting is required when the rights have been deposited, managed or obtained abroad. This group also includes investment funds, trusts and other collective investment schemes.

For assets, the name of the asset and name of the entity where the asset is held and address. The value of the assets per 31/12 for every year, the number of shares and value.

For insurance products, the name of the insurance company, the address and value for redemption per 31/12.

Income products and life insurances, the name of the entity, address and capitalized value per 31/12.

For property and property rights

- Identification of the property

- Address and country of the property.

- Date of purchase

- Value of purchase (special rules for multiple owners/properties such as timeshare or owned rental apartments)

This group includes houses, dwellings, apartments and terrains owned abroad.

If the assets hold abroad are less than 50 000 euros per 31/12 and the average held in bank accounts per the last quarter is less than 50 000 euros you will not need to declare.

Normally you do not have to present the form in certain cases:

The general rule is that assets below the 50 000 euro thresholds do not need to be declared, but beware that if the assets do reach that amount, even if it is a joint account you have to declare.

If some cases businesses who have the assets stated in the accounting do not have to declare. Although their representatives might have to declare.

If you have declared previous years, you only have to declare if the value has increased 20 000 euros in any of the assets declared and if there have been non closures of accounts or cancellations of policies.

If the entity is exempt from corporate taxes in Spain (for example public entities).

If the amount in total of all the groups is greater than 50 000 euros, you will need to declare all assets in all groups, even if the amount is smaller.

If the accounts are registered individually and identified in the accounting of an entity.

If you do not declare you risk heavy sanctions from the Spanish tax agency. The Modelo 720 is famous for the strict sanctions that the tax agency requires if you have not declared your foreign assets and that are later found at an inspection or through information sharing agreements between states.

Some news articles have gone as far as saying that the Modelo 720 is the weapon of mass destruction for the Spanish tax agency in their fight against tax evasion. Every year since 2012 there are thousands of Residents who have just discovered the Modelo 720 and got frightened that they have missed something and risk sanctions.

When it comes time to declare “La Renta” which is the usual income tax declaration in Spain, you might have asked the tax agency for your registered data and encountered a warning saying you have received income abroad and have not declared the source.

This could be for example declared interest income from a bank account without having declared the bank account!

The Spanish tax agency has several data sharing agreements with other states and the cooperation between various countries tax agencies are increasing every year. This means for example that a UK bank who is obliged to report assets and incomes from a UK bank account to the UK tax office will now also share the information with the Spanish tax agency through a cooperation agreement between Spain and the UK.

That means that suddenly information about a foreign interest income is available to the Spanish tax agency and they might start to wonder what is the basis for the interest, what accounts have not been declared? How have the assets been raised, are they illegal funds?

Even if the information sharing is increasing, it is also true that the Spanish tax agency has taken a step back from the most aggressive hunt for tax evasion using the form. A few years back the tax agency often chose to systematically add a sanction of 100 euros times each data point that needed to be declared which meant that a missed bank account abroad could lead to several hundreds of euros of fines even if the amount on the account was 0 euros.

It is also rumored that the amount of inspections focusing on the Modelo 720 has gone down through recent years. Where it earlier was often citing penalties of 150 % of the amounts held abroad. The reason for the decline in inspections and sanctions might be due to the critique the agency has received from the European commission. We will get back to this in a bit.

One of the main problems of the form is that if you have missed a deadline, there are no easy ways to rectify your situation.

A lot of people simply haven’t been aware of the existence of the obligation to declare. It is probably the most common case, where somebody has recently moved to Spain or who have inherited assets from abroad and not known that this needs to be declared separately even if there is no tax to be paid.

Most of these people also want to rectify their situation and have nothing to hide. In some cases they have already declared the income received from interest or shares in their annual income tax declaration from the assets held abroad but not known that they also have to declare the assets themselves – in a separate form – at a different time of the year.

Since there has been no reasonable way of presenting the form after the deadline without sanctions, many people who would have liked to declare the form have now chosen to become “tax fugitives” and hope that the tax agency does not find the assets.

This phenomenon has had a slight change in the recent times, not thanks to a change in attitude of the tax agency but rather because the critique of the European commission and because the Spanish courts have started to go against the tax agency in cases where it has been issuing sanctions. This means that people are getting less frightened by possible sanctions and confide in the Spanish courts that no unreasonable sanctions will be allowed. For example, if the tax agency issues heavy sanctions for withholding a bank account abroad with 0 euros.

Over 5000 persons have been sanctioned by august 2019 which you can read more about in El Pais newspaper following this link.

You do not want to be one of them.

The basic sanctions for not presenting the Modelo, for making errors or missing information is from 5000 euros per data or group of data while the sanction for presenting the Modelo after the deadline is 100 euros per date with a minimum of 10 000 euros for not reporting at all and a minimum of 1500 euros for reporting late.

Adding to this the tax agency might make a case for the assets being illegally obtained, for example undeclared income from abroad and choose to tax income tax as a person or as a company and adding 150 % of the amount as a penalty.

For example:

If you work abroad and save 70 000 euros from that work in a foreign bank account, this income might not have to be taxed in Spain.

If you have since then moved to Spain and still have the bank accounts abroad and miss to declare Modelo 720, the Spanish tax agency might think you have earned the 70 000 as income while being a tax resident in Spain and that you have hidden the 70 000 from Spanish income tax calculations. Then the tax agency would require you to pay income tax + a penalty of 150 % of the tax for “hiding taxable income”.

Unfortunately, there are aspects of the declaration which do not have a statute of limitation. This is one aspect which is being looked at by the Spanish courts at the moment.

If we also consider that every property has four types of data that need to be declared and the bank accounts five data types, you can easily see how the amount of penalties quickly add up. This also multiplied by the amount of years missed.

Adding to the above, if the accounts are jointly owned, both persons need to declare and by thus multiplying all the sanctions by two!

Now you see why it is important to declare it and why the European commission and the Spanish courts are not very happy about the sanctions.

There is one happy detail for persons who have recently moved to Spain. The possible sanction for “undeclared income” of 150 % does not apply if you were non-resident in Spain when you obtained the income and the income was earned while declaring the income in other countries. You would still need to present proof of this to the tax agency.

One of the most famous cases are of a retired taxi driver in Granada who had assets outside of Spain of 340 000 euros and was required to pay 442 000 euros in undeclared taxes and penalties.

Do I really need to present the Modelo 720? I heard the European Commission has taken a stance and made it invalid.

Yes, you still do need to declare the form in 2022 and going forward.

The European Commission has intervened in the use of the form and there are active Spanish court cases going against the tax agency, but the law and practice of the tax agency has not changed officially.

Since the latest ruling in the EU high court the Spanish government has pledged to change the sanctions regime regarding the form before 31/3/2022. This only affects the fines you might have to pay for not filing but you still have to file.

It is always advisable to declare – in time – if you can.

It is possible that we are coming to the end of the life of Modelo 720 but at the moment it is still in use.

You have mentioned something about the European Commission and the Modelo?

At the beginning of 2013, a Spanish lawyer named Alejandro Del Campo took Spain to the European Commission with regards to the form. Beginning with this claim, the commission started a procedure of an infraction against Spain. Since the Spanish defense against the claim did not have sufficient backing, the commission sent a letter in February of 2017. In the letter there was a requirement of changing the norms within two months, because the form and its sanctions regime was hurting the free movement of capital, the free movement of persons and the free movement of labor, establishment and offering services. You can read more about the case here on the law firms Spanish website

Here is also a good article from Cinco Dias newspaper about the European case if you read Spanish.

If you already find yourself in a difficult situation where you have missed to declare or having received notification of sanctions from the tax agency, do not worry too much. There is a good chance that you can get rectification by challenging the tax agency in Spanish courts. The number of court cases going against the tax agency is increasing and the focus on the topic is increasing for every month. If you do face heavy sanctions, please do get advice on how to proceed.

With regards to the basic sanctions of the 100 euros per data point with a minimum of 1500 euros, the Tribunal Económico-Administrativo Regional de Valencia has in two resolutions from 29-9-2017 annulled the penalties because the tax agency has not been able to sufficiently show the guilt of the taxable person. The court states that to demand these kinds of penalties the guilt of the taxable person should be backed up heavy evidence.

Also, the high court of Castilla y León have in a sentence 28/11/2018 declared these sanctions avoid for being disproportionate.

Even though many of the court cases have gone against the tax agency, there are still cases which do favor the states interpretation of the rules and does not rule of penalties for undeclared income even if the income was received for years when the income tax has reached a limit of statute by time. The Tribunal Económico-Administrativo Central (TEAC) has in some cases considered it correct to pursue undeclared funds in the fight against fraud and tax evasion.

The court has gone against the tax agency in the way it requires proof for funds in some cases. If we take the case of a property held abroad which was bought by savings, the tax agency would require proof that all the savings over the course of 10-20 years would be declared and that you would need to present the tax declarations abroad as evidence.

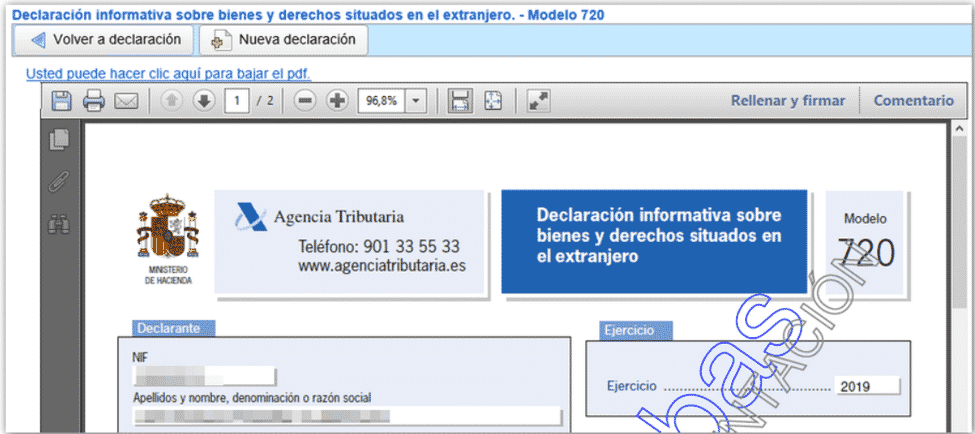

The form needs to be filled in online at the tax agency’s website. You will need a digital certificate valid for filing taxes. There also exists a program to help filing the taxes correctly in Spanish.

- You have to enter the website of the tax agency and Access Modelo 720 Declaración informativa sobre bienes y derechos situados en el extranjero. Then continue todeclaración con la firma electrónica and select your digital certificate.

- If the form is correctly presented, you will receive a verification number with the time and date or presenting the form.

- You should keep a copy of this for future reference.

- The tax agency reviews the information and checks that everything complies with the norms.

The form may be presented by the taxable person or by a representative. If you need any help, please do check out our site for declaring the form or send any questions to info@staminawebs.com.

If you speak Spanish, here is a video about the norms surrounding the form which is shares by the tax agency. https://youtu.be/yBs9epZN3yk

Here is also a video in Spanish about filling in the form which might be help if your spanish is OK.

Does presenting the tax affect my other taxes?

As we have explained, the tax form is of informative nature only, without collecting any taxes.

The tax form may have implications for your other taxes in the following ways.

Estate taxes

If you declare amounts abroad these may be included in the Spanish estate taxes. If the amounts abroad exceed 500 000 euros it is quite probable that the person would need to file a tax return for estate tax.

Income taxes

If the assets declared in the Modelo incur some form of income, for example dividends from shares or interest from accounts, this would be taxable income in Spain for residents. As a resident in Spain you are responsible for declaring your global income, for example rents obtained from property abroad. You might later be able to claim back tax from one of the countries according to a double taxation treaty.

We have also earlier mentioned the relationship between possible sanctions and undeclared income.

Modelo D6

If you own shares abroad, you will also need to declare a Modelo D6, even if the amount is less than 50 000 euros and you have more than 10 % of the voting rights or capital of the company.

If you have read all of this, you already know the following

- You need to declare assets held abroad 50 000 euros if you are a Spanish Tax Resident.

- If you do not declare them, you will face sanctions which are high enough to make you want to take court action against the Spanish state.

- It’s not very easy to complete and send the form, especially if you do not have a digital certificate.

- The form does not imply any taxes to be paid.

- To get it done, please click here.

- If you have missed, you should do it after the deadline

- If you have been sanctioned, you can and might want to appeal these in court and act swiftly to suspend the sanction.

- If you have already paid sanctions, you should file for a return of the penalties to not risk missing out statute of limitation while waiting for a ruling from the European Court of Justice.

- At the moment, in February 2022, do file the Modelo but do not get scared if you have missed something but do get advice from experts.

More information and articles in Spanish.

An article in El Pais newspaper.

Los tribunales frenan las multas de Hacienda por los bienes en el extranjero

Hacienda señalará en la campaña a contribuyentes con cuentas en el extranjero

Behöver du hjälp med andra spanska skatter?

Allmänna villkor | Hantering av personuppgifter, kakor och integritetspolicy. Spanskt skattenummer ESY6837028Q.