Agencia tributaria

Experts in Spanish tax form – Modelo 210

Simplify your Non-Resident Tax

- Modelo 210 from 34,95€

Own property in Spain but live elsewhere? Our expert team will handle your Non-Resident Tax quickly and easily. With our online process, you’ll be done in less than five minutes—just answer a few questions, and we’ll take care of the rest.

Every submission is carefully reviewed by a licensed specialist, ensuring your tax filing is accurate and stress-free. Enjoy the convenience of direct debit payment and peace of mind knowing you’re compliant with Spanish tax laws.

Non Resident Tax Spain

Your Taxes Filed in Minutes, Verified by Experts

Some things still need a human touch! Answer a few questions online, understand your tax obligations in Spain and our authorized experts will handle your taxes.

Fill in your details

Answer a few questions, and we'll determine which Spanish taxes apply to you. We're here to help via phone, chat, or email.

We file your taxes

We calculate, verify, and submit your taxes to the Spanish tax authority, setting up direct debit for easy payment.

You're all set

Receive your tax return, with the payment processed directly from your Spanish bank via direct debit.

If you own a property in Spain but live outside the country for more than 183 days a year, you must pay the Non-Resident Tax (Modelo 210).

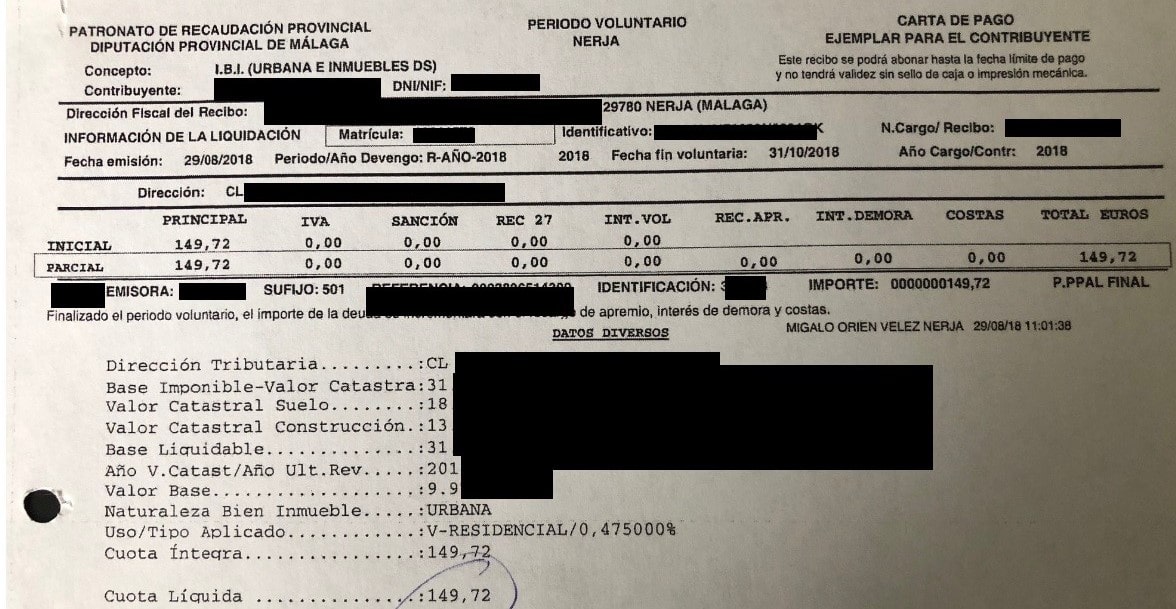

In addition to the municipal property tax (IBI), you need to file an annual tax return for your property. Our service lets you file online and have your tax return reviewed by a specialist. It’s quick, easy, and secure!

- Complete the process in 5 minutes!

- Risk-free: Pay after you receive your tax return.

- Discount available for multiple owners.

Taxadora Spain Reviews

+5000 happy clients

Form 210 Spain

Questions and answers

What is the Non-Resident Tax Modelo 210?

How Much is the Non-Resident Tax in Spain for Modelo 210?

Do I Need to File a Non-Resident Tax Return in Spain if I Own Property?

When is the Deadline for Filing Non-Resident Tax (Modelo 210) in Spain?

How to Find Your Valor Catastral for Non-Resident Tax 210 Form?

Do Co-Owners Need to File Non-Resident Tax Separately for Modelo 210?

Do I Need to Pay Non-Resident Tax if I Don’t Rent Out My Property?

How Do I File Rental Income Tax as a Non-Resident Using Modelo 210?

Do I Need Receipts for Deductions in the Non-Resident Tax (Modelo 210)?

If you do rent your property and live in a EU-country, you can make deductions from rental income. Generally, receipts are not required when declaring deductions. However, the Spanish tax authority may request documentation, so it is recommended to keep receipts for all deductible expenses. This tax is usually a preliminary declaration, and receipts may only be required upon further review.

What Happens if the Non-Resident Tax Isn’t Paid on Time?

If your payment is not collected via direct debit, it could be due to incorrect bank details or the use of a passport number instead of your NIE. If the payment fails, contact us immediately, and we will help resolve the issue. Delays or missed payments can lead to penalties, and the Spanish tax authority has access to European tax records.

Modelo 210 online form

Start your tax return here

1. Prepare yourself

Before you file taxes with us the first time, you will need to have:

2. File your Modelo 210 in 5 minutes

This tax declaration is for you who:

- You want to file the yearly Non-Resident Tax in Spain on Modelo 210.

- You have your tax residence outside of Spain.

- You don't have other income than from property in Spain.

- Both for you who rent out your property and who do not.

3. File your taxes now (almost done)

- Opening times (phone or chat)

- Monday-thursday 10.00-18.00

- Fridays 10.00-15.00

If you wish to reach us by chat, you can go to www.facebook.com/taxadora/

Address

Services

- Copyright © 2024 Taxadora

- General conditions

- Data protection, Cookies and integrity policy