Please note, after a rule change in February 2024;

- All rental income received during 2024 has to be declared annually in January 2025.

- Quarterly tax returns are no longer needed for 2024.

- If you have missed earlier tax returns 2023 or before, you still have to file quarterly tax returns for these periods.

1. Prepare yourself

Before you present taxes with us the first time, you will need to have:

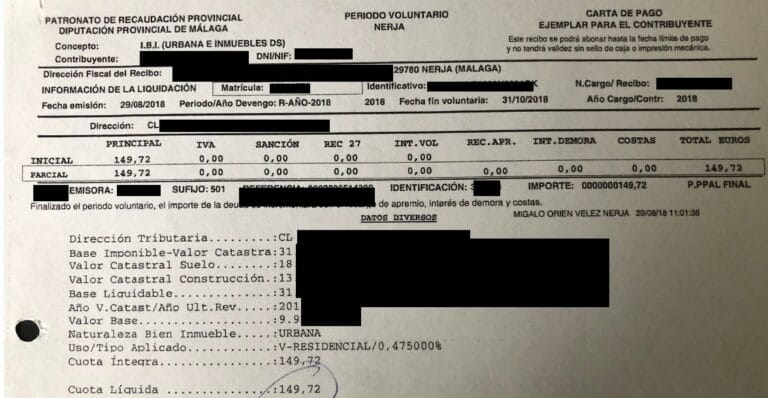

- Referencia catastral (property number) and Valor Catastral which you will find on your IBI-receipt.

- Your NIE number

- Account number in Spanish bank (IBAN-Number)

- Income received and number of days rented

- Summary of costs you would like to deduct.